Short Term Interest Rates (STIR) Futures markets down, Market expects central bank interest rate hikes in the future to slowdown the economyīonds Low-Risk long-term Bonds (US, Germany) Down, higher-risk long-term Bonds (Europe Peripheral Countries, Emerging markets) Up – dynamics dependent on inflation expectationsĬurrencies US Dollar moderate, Currencies related to cyclical sectors and commodities up, Risk Off currencies moderate Sectors: Cyclical Sectors stronger than Defensive Sectors

:fill(white):strip_exif()/f/image/WSV7mGObeJfUY9jlYfVEnz2v.png)

During risk-on periods: Stocks: Global Stock Markets Up, US Stocks Breadth Up, Momentum & Trends Up During risk-off environments, bonds (under certain conditions) and cash are the best asset classes since there are widespread corporate earnings downgrades, contracting or slowing economic data and uncertain central bank policy. This environment is carried by expanding corporate earnings, optimistic economic outlook, and accommodative central bank policies.

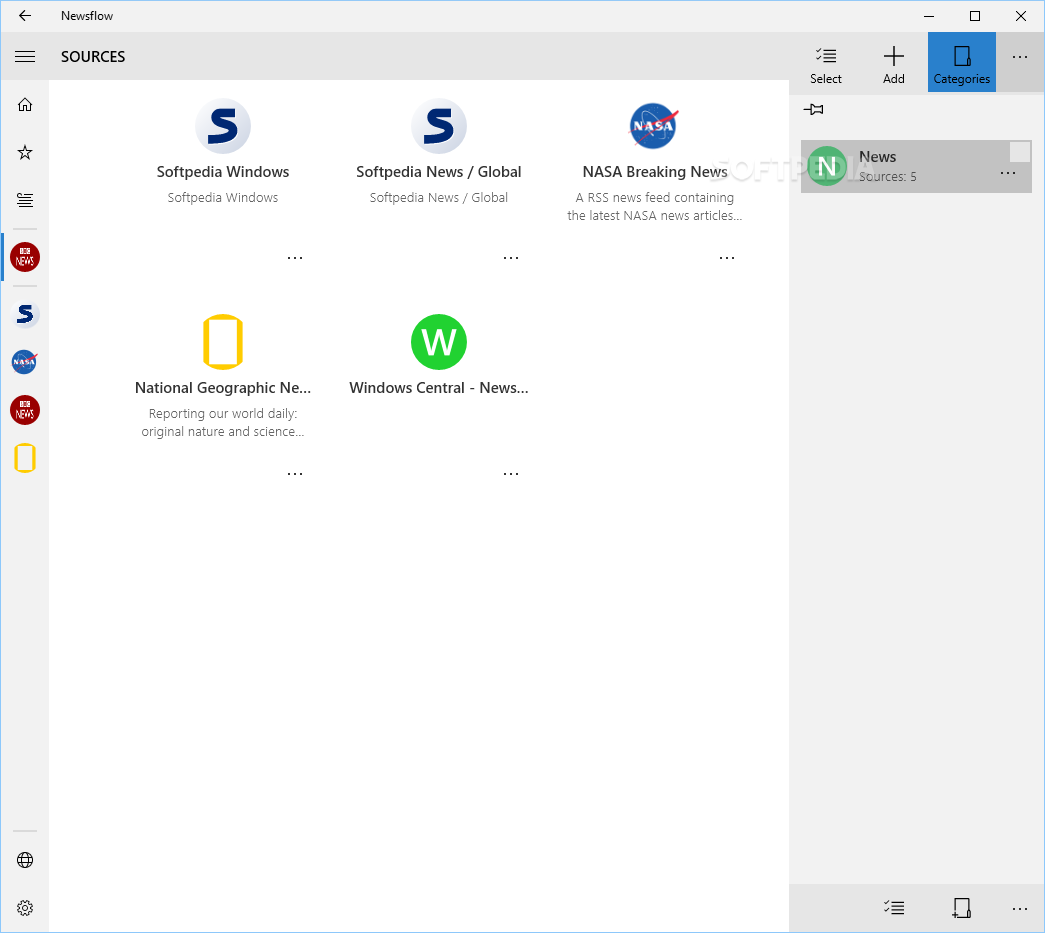

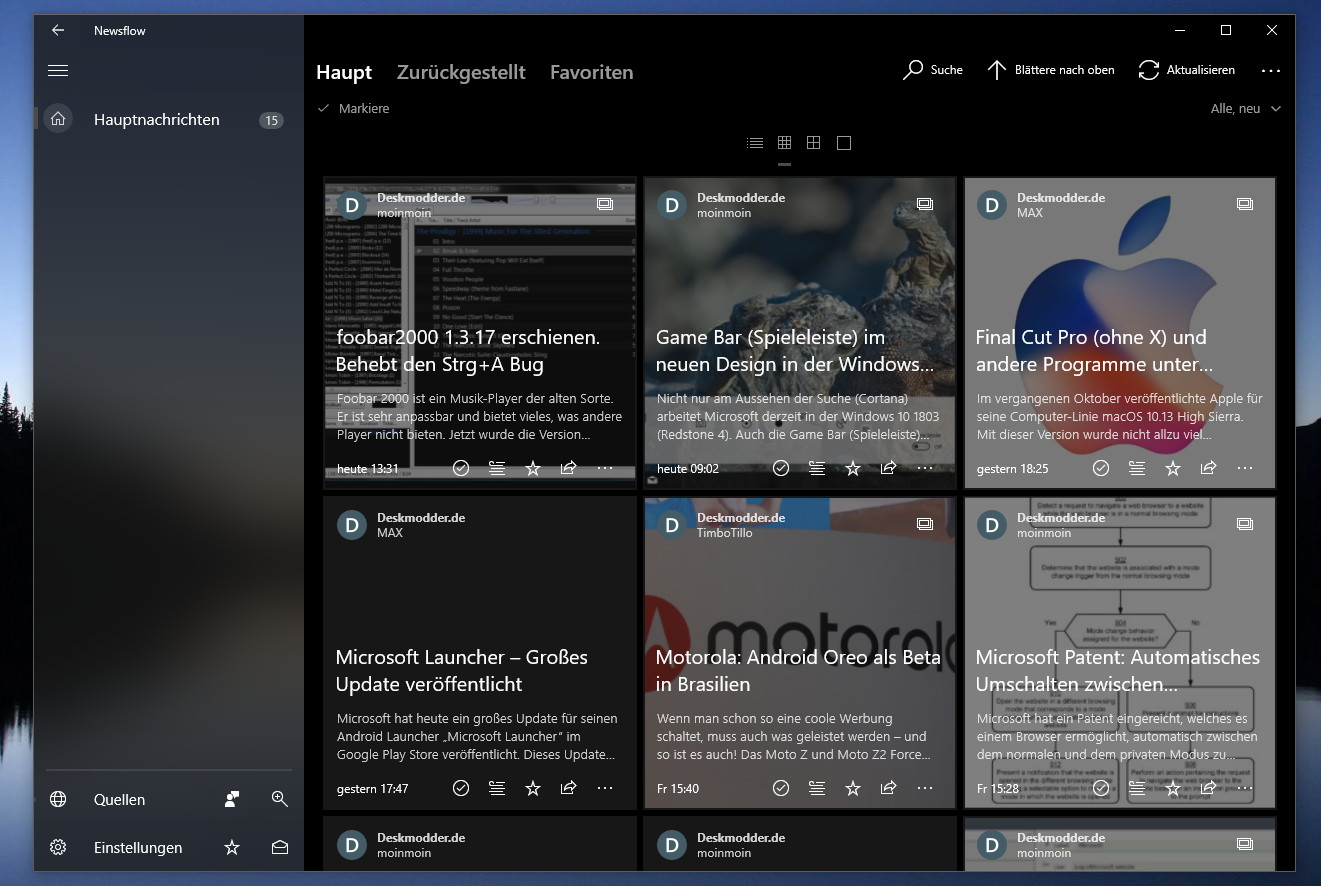

NEWSFLOW 2.0.24.0 MAXN SERIES

MacroVar Models a series of advanced statistical models to gauge financial conditions and notify MacroVar users beforeĭuring Risk-on environments stocks and commodities are the best asset class. The most important factor in investing and trading having a view of whether the global macro and market environment is risk-on or risk-off.

MacroVar models monitor Global Macro, Geopolitics, Price dynamics and factors affecting specific financial markets. MacroVar’s aim is to provide you with the financial research, data analysis and statistical models to help you maximize your portfolio’s risk adjusted return.įinancial markets are affected by macroeconomic conditions.

0 kommentar(er)

0 kommentar(er)